Employer Quarterly Gross Earnings Report

Pursuant to BA 1-501 and FLTTA Article 5, is due within 15 days after the close of each calendar quarter. The report must list all persons employed in DGA-covered categories along with their projects, last four digits of their social security number, and total gross earnings for that quarter. Each report may cover only one signatory company but may include more than one project by that signatory company.

Gross earnings include, but are not limited to:

- Salary (prep, shoot & post)

- Extended Workday/Overtime

- Vacation Pay

- Production Fee

- Turnaround Pay

- Series Sales Bonus

- Completion of Assignment

- Holiday Pay (worked/unworked)

- Capricious Discharge Pay

Gross earnings should not include residuals payments of any kind, per diem (including incidentals), travel allowance, profit participation, gross participation and reimbursements which are not compensation for services rendered under the BA or FLTTA.

Employment Data Report (EDR)

Pursuant to Article 15 of the DGA Basic Agreement and Article 19 of the DGA Freelance Live & Tape Television Agreement, Employers must submit an Employment Data Report identifying the gender and ethnicity of persons employed in DGA-covered categories. The report must also identify Directors employed on prime time dramatic television programs who have no prior credits on such programs.

Employment Data Reports must be submitted:

- once for a theatrical motion picture, television motion picture ninety (90) minutes or longer, pilot, presentation or single program and is due within 45 days after close of principal photography;

- once per season for an episodic television series and is due within 45 days after the wrap or recording of the last episode; or

- once per year for strip dramatic, strip variety, quiz and game and “All Other” programs produced on an annual rather than seasonal basis and is due no later than February 15th of each year following production.

If the Employer is unable to submit the EDR within the above time periods, it may request an additional 15 days within which to submit the EDR. The Guild will not unreasonably deny the Employer’s request.

Each EDR may cover only one motion picture, one season of an episodic television series, one year of an annual program or one single project. The EDR identifies the gender and ethnicity of persons employed on that motion picture, season, year or single project. The EDR should not include DGA Trainees.

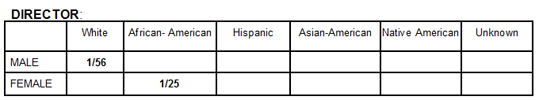

Two types of statistics must be reported in the following format:

1. Indicate the number of persons employed in the categories listed below:

- White

- Asian-American

- African-American

- Native American

- Hispanic

- Unknown

2. Indicate the total number of days worked or guaranteed. Total days should include travel days, prep days, production days and post-production days. When the same member is employed on multiple episodes in a series, the employee should only be counted once in the number of employees, but all the employee's cumulative days worked should be included in the total number of days worked or guaranteed.

The below example shows one male White director was employed for a total of 56 days worked or guaranteed. One female African American director was employed for a cumulative total of 25 days worked or guaranteed.

Weekly Work Lists

Pursuant to BA 1-501, show all persons employed in DGA-covered categories during the prior week along with their categories, projects and dates of employment. Each Weekly Work List may cover only one project and should not include DGA Trainees.

Note: Category distinctions are important. To avoid confusion, please use these abbreviations:

- Unit Production Manager = UPM

- First Assistant Director = 1AD

- Key Second Assistant Director = 2AD

- Second Second Assistant Director = 2nd 2AD

- Additional Second Assistant Director = Add'l 2AD